Trending

- Maha Kumbh 2025: The Grandest Spiritual and Cultural Convergence in History

- Exploring MyTravelTown and Its Visionary Founder, Kartik Rajput

- MyTravelTown: India's First Travel Listing Platform

- Hope You Have Not Fallen Prey To The Rs.50 delivery scam with Zomato!

- ZeroPe: Ashneer Grover's Bold Leap into the Booming Medical Loans Market

- Ashneer Grover: From BharatPe to Being a Shark

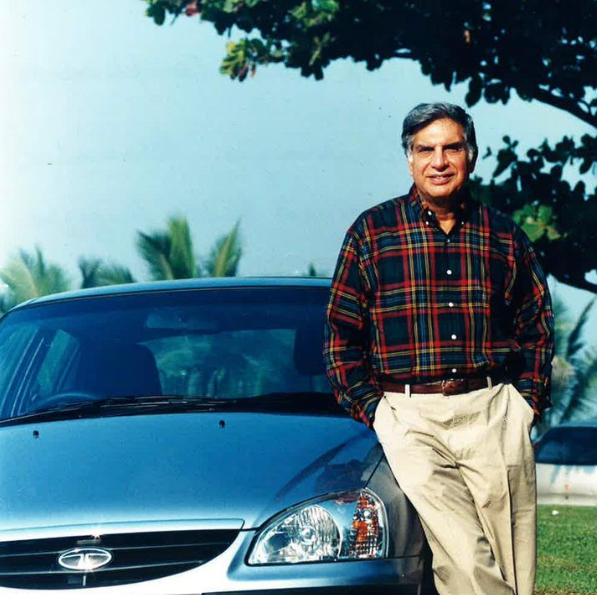

- Ratan Tata: The Visionary Behind India's Industrial Renaissance

- Ratan Tata: A Visionary Leader Who Took the Tata Group Global

- From IIT to Fintech Titan: The Inspirational Journey of Ashneer Grover

- The Rise of Freelancing and Independent Work

- Building a Sustainable and Socially Responsible Business

- The Evolving Customer Journey: Mastering Omnichannel Marketing

- Zerodha's Nikhil Kamath Acquires Sachin Bansal's Stake in Ather Energy: A Milestone for India's EV Industry

- Shark Tank India 3: Aman Gupta's Net Worth Decline Sparks Discussion

- From Teenager to CEO: Farrhad Acidwalla's Journey with Rockstah Media

- Peeyush Bansal: Revolutionizing Eyewear with Lenskart

- How to finance a business endeavor is one of the most critical decisions that entrepreneurs must make: Let’s see how

- Crucial Tips for Building and Managing a Thriving Remote Team in 2024

- Why Narrowing Your Focus Can Be Your Startup's Secret Weapon?

- Harnessing the Power of Social Media Marketing for Startups in 2024: Trends & Strategies

- The Art of the Pivot: When to Change Course and How to Do it Successfully

- Microsoft Meltdown: Unpacking the Chaos, CrowdStrike's Role, and Dodging the Blue Screen of Death

- The Titan of Indian Industry and Philanthropy, Ratan Tata

- Allies Back PM Modi for Historic Third Term Amid Election Drama

- Modi's Coalition Leads in Majority of Seats in Early Count But Faces Stiff Opposition

- Embracing AI: How Finland's Coffee Industry is Innovating with Technology

- She Means Business: Women Leading the Charge in Indian Startups

- The Rise of the Gig Economy: How Startups are Shaping India's Future of Work

- Businesses beyond the boundaries of Metro Cities

- AI transforming the business landscape of India

- The value of Ideas in the world of startups

- Bootstrapping vs. Funding: Choosing the Right Path for Your Startup in 2024

- Bollywood glams routing out a successful business career

- An insight into the lives of the power couple: Sudha and Narayan Murthy

- Zomato & Swiggy: The never-ending tussle

- Tale of an Amazing Startup: DiGi Marshall

- Shark Tank India: The Pitches That Landed Millions

- The entrepreneur who started too young: Ritesh Agarwal

- Democratization of AI: From Sci-Fi Dream to Everyone's Toolbox

- AI Goes Picasso: Generative AI Paints a New World of Content

- Welcome to the Metaverse: Buckle Up for Web 3.0

- Quantum Computing: Leaping Beyond the Limits of Today's Tech

- Going Green: Sustainable Tech Takes Center Stage

- Digital Marketing helps to generate online Business

- Will the market be affected by the 2024 election?

- Anupam Mittal's Net worth

- Tips to know about Shark Tank India Season 3

- Unveiling the Business Tale: Maldives Ebb and Lakshadweep's Flow

- Earn money from Zero Investment

- Best CRM tool to Improvise the Project

- Aman Gupta's Net Worth

- Ashneer Grover: A Great Businessman

- Best Analytical Tool in 2024

- Does Layoff makes company profitable?

- Gaurav Aggarwal Founder of Savaari

- Dinesh Goel Co-founder of Aasaanjobs

- Startup update Bounce E-Vehicles

- India Growth in Tech Startup

- 8 ways to earn money from home without investment

- Wysa- Health & Care

- Rohina Anand Khira, Owner of AA Living

- Startups are going to be the backbone of new India|Bharat

- Lava Made in India 5G Smartphones

- 7 Lessons from Jeff Bezos for any Business

- 10 ways to grow your business online

- Which movie has taught you the best Entrepreneurial lessons?

- Health Start-Up Wellversed

- Arvind Kejriwal plans to make Delhi Global Startup Hub

- Dunzo Launches Food Court

- How to Make Money Online Without paying anything?

- Entrepreneur Update of Ajesh Joy Co-founder of Ghar360

- ELON MUSK NET WORTH

- Whatsapp will stop working if you do not agree to its new terms by May 15

- Latest Upcoming 5G Smartphones

- How to start a small online business?

- Startup Update Of Ultraviolette Superbikes

- LESSONS FROM FRANK D'SOUZA FOR ANY BUSINESS

- 10 Lessons from Larry Page for any Business

- 10 Lessons From Satya Nadella For Any Business

- Top Lessons from Paul Jacobs for any Business

- Top Lessons from Sundar Pichai for any Business

- TOP LESSONS FROM HOWARD SCHULTZ FOR ANY BUSINESS

- Top Lessons from Elon Musk for Entrepreneurs

- Top Lessons from Tim Cook for any Business

- 10 Lessons from Dominic Barton for any Business

- 10 Lessons from Jim Turley for any Business.

- 10 Lessons from Warren Buffet to be a Trader

- 10 LESSONS FROM BILL GATES FOR ANY BUSINESS

- 10 Lessons from Jack Ma for any Business

- How to start a small online business?

- Digital Marketing helps in Business

- How Facebook gives huge Money?

- Top 3 Social Media Platform

- Want to be Entrepreneur?

- Top 5 Entrepreneur Facts

- Which Social Media Platform is best for your Career?

- Best Broker for Trading in India

- What is Viral Marketing and Referral Marketing?

- How to become famous on Facebook?

- How to be famous on Instagram?

- How to use Youtube to grow your business?

- 7 lessons from Jeff Bezos for any Business

- TOP LESSONS FROM RITESH AGARWAL FOR STARTUP

- Which social media platform is best for your career?

- Top Lessons from Vijay Shekhar Sharma for any Startup

- 7 lessons from Ratan Tata for Entrepreneurs

- 7 Tips from Mark Zuckerberg for Any Business

- How to do trading in the stock market?

- How To Become Famous On Instagram?

- What is Viral Marketing & Referral Marketing?

- Want to be an Entrepreneur?

- Top Best Broker For Trading In India

- How to become famous on YouTube?

- Top 5 Entrepreneur Facts

- How to Become Famous on Facebook?

- How Instagram helps in Career?

- How Facebook helps in Career?

- DIGITAL MARKETING HELPS IN BUSINESS

- How Facebook Gives Huge Money ?

- How Youtube gives huge money?

- How Youtube helps to grow your business?

- How Instagram gives huge money?

- Gautam Adani- CEO of Adani Group

- 6 Ways Social Media Changed The Way We Communicate

- Ratan Tata Net Worth

- Richard Grasso Net Worth

- Moovlee - A complete online app based solution for taxi service providers

- How to use hashtags on Instagram ?

- How to make money from youtube?

- Sujata Chatterjee - Twirl.store

- Want to grow your Business ?

- What is Referral Marketing ?

- Abhilasha Purwar - Blue Sky Analytics